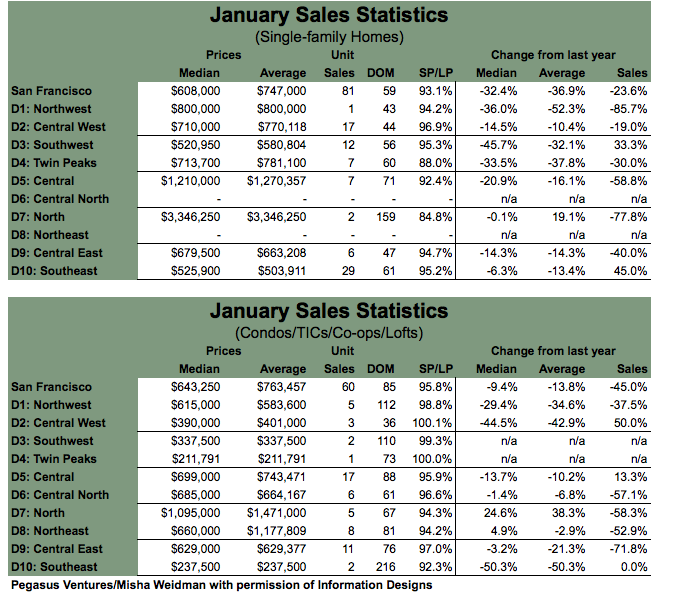

Here’s the latest sales data broken down by MLS District. Full reports are available here under the Market Trends Tab and are well worth a look.

Median and Average prices are down substantially year over year for single family homes in all districts except District 7 (“North”, which includes top-shelf enclaves like Pacific Heights and the Marina), but with only 2 sales for the month in that area, it’s not a meaningful statistic. Indeed, as I’ve pointed out in previous blogs, sales drop off so dramatically every year during December/January that I’d be cautious reading too much into the statistics for those particular months. ...